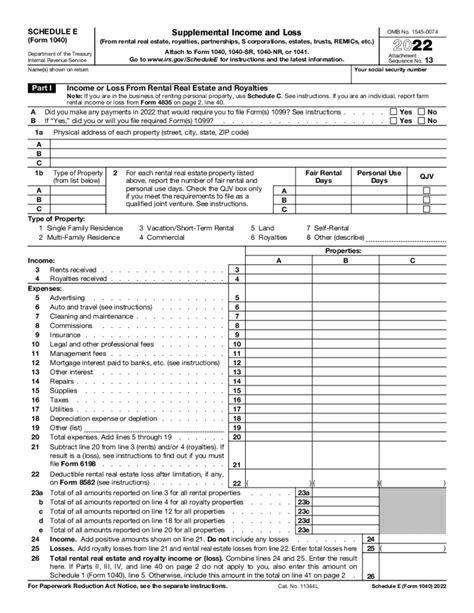

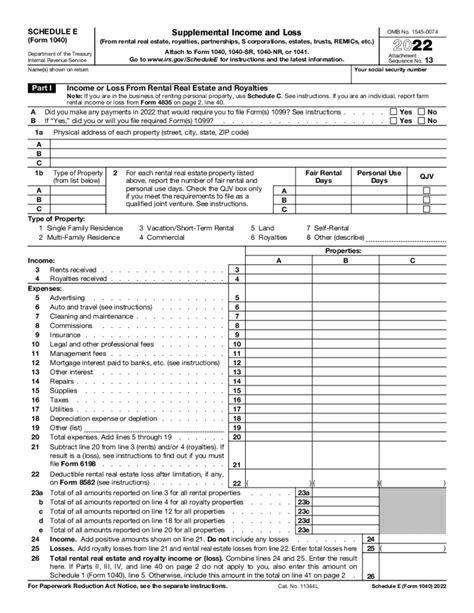

schedule e form 1040 instructions|printable schedule e form : Cebu 2021 Instructions for Schedule ESupplemental Income and Loss Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S .

webWe would like to show you a description here but the site won’t allow us.

0 · schedule e instructions pdf

1 · printable schedule e form

2 · irs schedule e instructions 2023

3 · irs 1040 schedule e 2022

4 · instruction 1040 pdf

5 · form 1040 instructions 2023 schedule e

6 · blank schedule e tax form

7 · More

8 · 2023 1040 schedule e instructions

WEBWhile the only weapon showcased in the trailer seems to be RoboCop’s signature Auto 9 pistol, there seem to be many creative and brutal ways to dispatch the bad guys in dystopian Detroit. Title: RoboCop: Rogue City. Genre: Action, Adventure. Developer: Teyon. Publisher: Nacon. Franchise: Nacon.

schedule e form 1040 instructions*******Learn how to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs on Schedule E (Form 1040). Find out what's new, what forms and schedules to file, and how to claim .Information about Schedule E (Form 1040), Supplemental Income and Loss, .2021 Instructions for Schedule ESupplemental Income and Loss Use .For 2022, you will use Form 1040 or, if you were born before January 2, 1958, you . Learn how to report income or loss from various sources on Schedule E (Form 1040), Supplemental Income and Loss. Find the current revision, PDF, and .

2021 Instructions for Schedule ESupplemental Income and Loss Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S . Schedule E is a tax form that asks information about certain rental and royalty income, real estate investments, and pass-through business income. It gets .

Filing Your Taxes. Schedule E Tax Form. Here's what the Schedule E looks like: You can download the most up to date Schedule E from the IRS website here. Rental Income. If you have rental income, .

Schedule E is a form that taxpayers should use to report non-employment income from various sources, including S corporations, partnerships, trusts, and rental real estate. The form is meant to be .For 2022, you will use Form 1040 or, if you were born before January 2, 1958, you have the option to use Form 1040-SR. You may only need to le Form 1040 or 1040-SR and none .

Learn what schedule E is, who needs to file it, and how to fill it out properly. This guide covers rental income, royalties, partnerships, estates, trusts, . Learn how to use IRS Schedule E to report income and loss from partnerships, S corporations, rental properties, and other sources. Find out the differences between Schedule E and Schedule .2019 Instructions for Schedule ESupplemental Income and Loss Use Schedule E (Form 1040 or 1040-SR) to report income or loss from rental real es-tate, royalties, partnerships, S corporations, estates, trusts, and residual interests in RE-MICs. You can attach your own schedule(s) to report income or loss from any of these sources. Schedule E is a tax form that asks information about certain rental and royalty income, real estate investments, and pass-through business income. It gets attached to your main tax return, Form 1040. Information about Schedule 8812 (Form 1040), Additional Child Tax Credit, including recent updates, related forms, and instructions on how to file. Use Schedule 8812 (Form 1040) to figure the additional child tax credit. The additional child tax credit may give you a refund even if you do not owe any tax.SCHEDULE E (Form 1040) 2022 Supplemental Income and Loss (From rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs, etc.) . Schedule C. See instructions. If you are an individual, report farm rental income or loss from . Form 4835 . on page 2, line 40. A.

Step 2: Understand the sections. Schedule E is divided into three main sections: Part I - Income or Loss from Rental Real Estate and Royalties, Part II - Income or Loss from Partnerships and S Corporations, and Part III - Income or Loss from Estates and Trusts. Understand which sections apply to you based on your income sources.3. Include Form 8962 with your Form 1040, Form 1040-SR, or Form 1040-NR. (Don t include Form 1095-A.) Health Coverage Reporting. If you or someone in your family was an employee in 2022, the employer may be required to send you Form 1095-C Part II. of Form 1095-C shows whether your employer offered you health insurance coverage and, if2023 Instructions for Schedule ESupplemental Income and Loss Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources. Use the same format as .

schedule e form 1040 instructions printable schedule e form For the majority of private landlords, you’ll likely only need to complete Part One of the Schedule E tax form. In the first section of the Schedule E (Form 1040) you’ll be listing the following information: Line 1. Physical address of each property and Schedule E property types. The property types available are Single Family Residence .

Per the IRS Schedule E instructions: . Whatever appears on line 26 will also appear on line 8 of your Form 1040. Make sure that flow is happening correctly to avoid issues. Reporting Car Expenses and What You Need to Know . You’ll use IRS Form 4562 to report your car expenses and claim those beautiful IRS deductions.Page Last Reviewed or Updated: 18-Jun-2024. Information about Form 1040, U.S. Individual Income Tax Return, including recent updates, related forms and instructions on how to file. Form 1040 is used by citizens or residents of the United States to file an annual income tax return.

U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 23, 2023. Free printable 2023 Schedule E form and 2023 Schedule E instructions booklet sourced from the IRS. Download and print the PDF file. Then, calculate your Supplemental Income and Loss and attach to Form 1040. Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources. Use the same format as on Schedule E. Enter separately on Schedule E the .Don't include on Schedule A items deducted elsewhere, such as on Form 1040, Form 1040-SR, or Schedule C, E, or F. Future developments. For the latest information about developments related to Schedule A (Form 1040) and its instructions, such as legislation enacted after they were published, go to IRS.gov/ScheduleA .Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. . Clarification of charitable contribution deduction limits in the 2022 Schedule A (Form 1040) instructions-- 08-MAR-2023. Other items you .

U.S. Department of the Treasury, Internal Revenue Service. Retrieved November 23, 2023. Free printable 2023 Schedule E form and 2023 Schedule E instructions booklet sourced from the . Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources. Use the same format as on Schedule E. Enter separately on Schedule E the .

Don't include on Schedule A items deducted elsewhere, such as on Form 1040, Form 1040-SR, or Schedule C, E, or F. Future developments. For the latest information about developments related to Schedule A (Form 1040) and its instructions, such as legislation enacted after they were published, go to IRS.gov/ScheduleA .

Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. . Clarification of charitable contribution deduction limits in the 2022 Schedule A (Form 1040) instructions-- 08-MAR-2023. Other items you .

Schedule E on From 1040. Consult a Tax Professional. For More Information. With its tax advantages and range of benefits, family members often find it ideal to form a limited partnership in order to pool their capital to make investments that they would not have otherwise been able to do on an individual basis because of their smaller account . Schedule E is a form that taxpayers should use to report non-employment income from various sources, including S corporations, partnerships, trusts, and rental real estate. The form is meant to be filed with IRS form 1040 when you file your annual tax return. In some cases, some of the same types of income should be reported on other .For 2023, Schedule C (Form 1040) is available to be filed with Form 1040-SS, if applicable. It replaces Form 1040-SS, Part IV. For additional information, see the Instructions for Form 1040-SS. Standard mileage rate. The business standard mileage rate for 2023 is .

schedule e form 1040 instructionsFor 2023, Schedule C (Form 1040) is available to be filed with Form 1040-SS, if applicable. It replaces Form 1040-SS, Part IV. For additional information, see the Instructions for Form 1040-SS. Standard mileage rate. The business standard mileage rate for 2023 is .

printable schedule e formSchedule C. See instructions. If you are an individual, report farm rental income or loss from . Form 4835 . on page 2, line 40. A. . 2020 Schedule E (Form 1040) Author: SE:W:CAR:MP Subject: Supplemental Income and Loss Keywords: Fillable Created Date: 11/16/2020 10:02:43 AM .

2014 Instructions for Schedule E (Form 1040)Supplemental Income and Loss Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources.

SCHEDULE E (Form 1040) Department of the Treasury Internal Revenue Service Supplemental Income and Loss (From rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs, etc.) . Schedule C. See instructions. If you are an individual, report farm rental income or loss from .Schedule E is the official IRS tax form to report supplemental income, including real estate investments. You use Schedule E (Form 1040) to report income or losses from: Individual taxpayers who generate supplemental income from renting real estate – no matter the property type – must attach a Schedule E tax form to their IRS Form 1040.2015 Instructions for Schedule E (Form 1040)Supplemental Income and Loss Use Schedule E (Form 1040) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. You can attach your own schedule(s) to report income or loss from any of these sources.

WEB5 de jan. de 2024 · O Fluminense pode se classificar já na segunda rodada, então espero uma equipe centrada e muito forte contra o lagarto. O time paulista empatou na estreia, e o tricolor goleou. Meu palpite é de .

schedule e form 1040 instructions|printable schedule e form